livingston

20×102mm Vulcan

Used Car Repossession Rates Double for Both Sub-Prime and Prime Borrowers, Indicates Trouble on Main Street

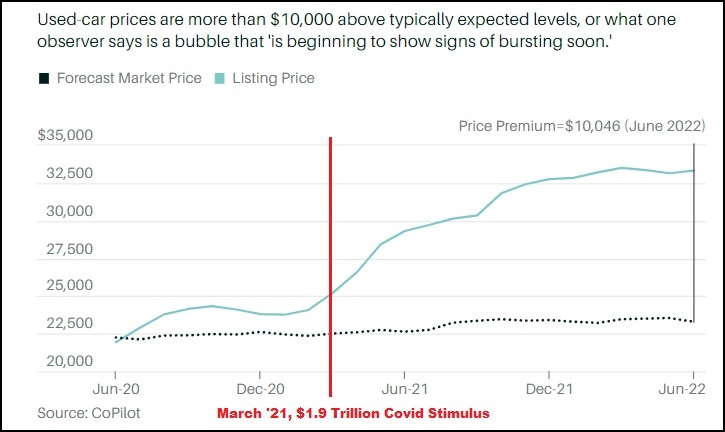

Barrons has an interesting article on an increase in bank auto repossession rates connected to defaults [see here]. Essentially, used car prices have surged significantly and the timeline seems to indicate the temporary covid-19 stimulus spending had a lot to do with the increase in demand.According to data assembled by CoPilot, used cars are currently priced approximately 10,000 higher than they would be without any pandemic related influence, supply side or demand side. Banks and financial institutions loaned money into the climbing market price. However, the artificially inflated car prices now create a bubble where the liability on the books is significantly higher than the repossessed asset is worth.

A higher rate of auto loans are now defaulting for both sub-prime and prime borrowers (double for both), indicating the former buyers are under financial pressure and can no longer make their car payments. The loan to value ratio was as high as 140% when the banks made the loans, a more traditional or normal ratio is 80%.

The banks have a vested financial interest in limiting the number of repossessed vehicles they allow into the used car auction market in order to keep the book value of the cars as high as possible. Those banks and financial institutions have recently rented more storage space for the vehicles being repossessed.

Used Car Repossession Rates Double for Both Sub-Prime and Prime Borrowers, Indicates Trouble on Main Street - The Last Refuge

Barrons has an interesting article on an increase in bank auto repossession rates connected to defaults [see here]. Essentially, used car prices have surged significantly and the timeline seems to indicate the temporary covid-19 stimulus spending had a lot to do with the increase in demand...