C3D

.308 Win

How many of NYC’s billionaires and hundred millionaires will move to Florida? Even the Bloomberg’s of the world can’t afford those kind of levies.

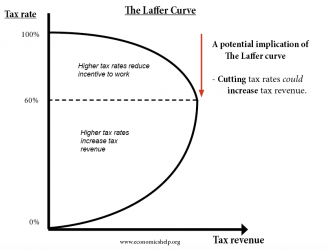

And these numbers don’t include social security tax, which was previously proposed to be 7.5% on the “rich” (>$400K per year, currently it’s capped at about $10K per year, will be uncapped under that old proposal). That takes you to 77.7%, at what point is it not worth doing anything anymore?

nypost.com

nypost.com

And these numbers don’t include social security tax, which was previously proposed to be 7.5% on the “rich” (>$400K per year, currently it’s capped at about $10K per year, will be uncapped under that old proposal). That takes you to 77.7%, at what point is it not worth doing anything anymore?

Build Back Better would make US income tax rate highest in developed world

The proposal currently before the House of Representatives would raise the average top tax rate on personal income to a whopping 57.4 percent.