You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bud's only shipping to FFL now

- Thread starter Froggy

- Start date

Froggy

.177 BB

4WHLDRFTN

.308 Win

Not many will ship to New Pork as of Sept 1st

Carlos Hathcock

.450/400 Nitro Ex

To the firearms community, NY has become the steaming pile of dogshit you avoid on the sidewalk.

Saltwater60

20×102mm Vulcan

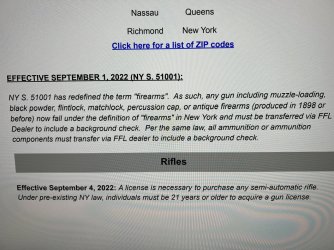

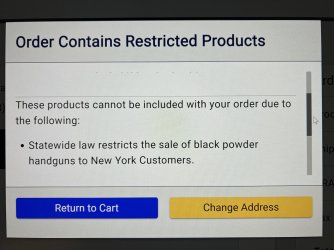

Wow ammo components. Never heard that before.

ronstar

.357 mag

What about Target Sports USA in Connecticut?

thughes

.223 Rem

Bud's is a 35 minute drive from here.....

Those of you that can, you need to get the fuck out of that communist state.

Those of you that can, you need to get the fuck out of that communist state.

Beerman

6.5 Creedmoor

Still shipping ammo to good peoples’ doors. Are you a good person?What about Target Sports USA in Connecticut?

Saltwater60

20×102mm Vulcan

Depends who you ask. Hochul probably wouldn’t say I’m good because I’m conservative.Still shipping ammo to good peoples’ doors. Are you a good person?

Beerman

6.5 Creedmoor

I’m not leaving the Adirondacks. This is my home. Intesrestingly, a lot of people say, “Just move to a free state,” when talking about guns and NYS. It’s as if owning guns is the pinnacle of life, yet, when the right to bear arms was amended in the Constitution, it was preserved such that the citizens of this nation could defend those things in life which were deemed essential: life, liberty, and the pursuit of happiness. Sure, that’s obviously from a different, yet monumentally important document regarding freedoms in this country, but it gets right to the point. The right to own guns is important; the things that are to be be protected and preserved by an armed citizenry are fundamental to the founding of our nation. It’s a chicken or egg, cart before the horse, eggs-in-one-basket case, all at once. Liberty protects our guns; our guns protect our liberty. Do we have liberty because we have guns, or do we have guns because we have liberty? Perhaps it is both, but I’m not leaving.Bud's is a 35 minute drive from here.....

Those of you that can, you need to get the fuck out of that communist state.

thughes

.223 Rem

I moved because I hate cold weather, ridiculously high taxes, and liberal politics; the 2A benefits are just icing on the cake.

I'm a staunch Libertarian, so ride your own ride man! It's all good......

I'm a staunch Libertarian, so ride your own ride man! It's all good......

Hochulsucks1234

.44 mag

I get sick of saying the same thing. I own 50 acres of wooded land with a good supply of water right outside the Adk park. I have very few neighbors and the people I do live around think like me (aka no liberals). I can go out my back door and piss or shoot off the porch (both at the same time if I spot a rabbit getting into the gardens!) Life is peaceful where I am and I do what I want.I’m not leaving the Adirondacks. This is my home. Intesrestingly, a lot of people say, “Just move to a free state,” when talking about guns and NYS. It’s as if owning guns is the pinnacle of life, yet, when the right to bear arms was amended in the Constitution, it was preserved such that the citizens of this nation could defend those things in life which were deemed essential: life, liberty, and the pursuit of happiness. Sure, that’s obviously from a different, yet monumentally important document regarding freedoms in this country, but it gets right to the point. The right to own guns is important; the things that are to be be protected and preserved by an armed citizenry are fundamental to the founding of our nation. It’s a chicken or egg, cart before the horse, eggs-in-one-basket case, all at once. Liberty protects our guns; our guns protect our liberty. Do we have liberty because we have guns, or do we have guns because we have liberty? Perhaps it is both, but I’m not leaving.

Could I sell it all and move south? Of course, but where and what cost? To even come close to matching the paradise I have here it would cost at least 500k. Land is almost impossible to find and when you do it is outrageously expensive. Sure I could find me a house on a couple acres where I won't be able to do half the things I can do here, all for the benefit of fewer gun laws and possibly lower taxes. I broke my ass getting this property where I want it. I will be damned to give it up all so easily.

To me the benefits don't outweigh giving up what I worked hard to build. Maybe there will come a point. Maybe when they tell me I can't heat with wood, have to drive an EV, ban the use of wells, or other crazy shit, then yes maybe I will say "f it" and go. For now, I can reload my own ammo, and if need be take a trip down to PA and stock up when needed. I shoot thousands of rounds on my own home range and no laws they force on us will stop me from doing that. I follow the act of civil disobedience when it comes to liberals and their laws.

Saltwater60

20×102mm Vulcan

For me I bought a house for $155,000 and my taxes are so high my wife was showing me $300,000-$330,000 Houses down south and I kept saying no way can we afford that why do you keep teasing me. Well turns out the payment is actually cheaper because the taxes are way cheaper. I’m looking at a reassessment right now and I project my tax bill after it will be $1,000/month and my mortgage right now is $1,350. My payment will near $2,000 if my projections are correct. I can’t do that, well I can but I just refuse to. I’ll keep it up until my younger son is out of high school and my son graduates college, but after that I’m out of at least my area and possibly the state. I have a plan and hopefully I can achieve that plan, but inflation and costs may impact that.I get sick of saying the same thing. I own 50 acres of wooded land with a good supply of water right outside the Adk park. I have very few neighbors and the people I do live around think like me (aka no liberals). I can go out my back door and piss or shoot off the porch (both at the same time if I spot a rabbit getting into the gardens!) Life is peaceful where I am and I do what I want.

Could I sell it all and move south? Of course, but where and what cost? To even come close to matching the paradise I have here it would cost at least 500k. Land is almost impossible to find and when you do it is outrageously expensive. Sure I could find me a house on a couple acres where I won't be able to do half the things I can do here, all for the benefit of fewer gun laws and possibly lower taxes. I broke my ass getting this property where I want it. I will be damned to give it up all so easily.

To me the benefits don't outweigh giving up what I worked hard to build. Maybe there will come a point. Maybe when they tell me I can't heat with wood, have to drive an EV, ban the use of wells, or other crazy shit, then yes maybe I will say "f it" and go. For now, I can reload my own ammo, and if need be take a trip down to PA and stock up when needed. I shoot thousands of rounds on my own home range and no laws they force on us will stop me from doing that. I follow the act of civil disobedience when it comes to liberals and their laws.

Hochulsucks1234

.44 mag

$1,000 a month in taxes? Hell id move too. I pay 4k a year with my acreage, house, and large garage.For me I bought a house for $155,000 and my taxes are so high my wife was showing me $300,000-$330,000 Houses down south and I kept saying no way can we afford that why do you keep teasing me. Well turns out the payment is actually cheaper because the taxes are way cheaper. I’m looking at a reassessment right now and I project my tax bill after it will be $1,000/month and my mortgage right now is $1,350. My payment will near $2,000 if my projections are correct. I can’t do that, well I can but I just refuse to. I’ll keep it up until my younger son is out of high school and my son graduates college, but after that I’m out of at least my area and possibly the state. I have a plan and hopefully I can achieve that plan, but inflation and costs may impact that.

Hochulsucks1234

.44 mag

Im not sure for life. Perhaps one of the kids can take over the property. That way me and the misses can then move to a place with low maintenance and visit when we can.Pretty much looks like I am a NYers for life also. I only have 1 acre, but I can do off my porch as you too Mr 1234! I cannot see my 2 neighbors houses from my yard. WE have more cows in my Town than people.

Beerman

6.5 Creedmoor

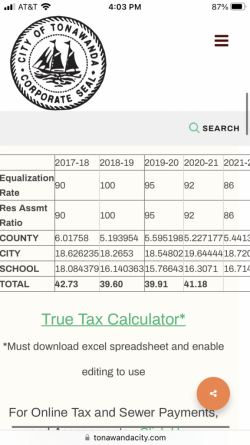

For me I bought a house for $155,000 and my taxes are so high my wife was showing me $300,000-$330,000 Houses down south and I kept saying no way can we afford that why do you keep teasing me. Well turns out the payment is actually cheaper because the taxes are way cheaper. I’m looking at a reassessment right now and I project my tax bill after it will be $1,000/month and my mortgage right now is $1,350. My payment will near $2,000 if my projections are correct. I can’t do that, well I can but I just refuse to. I’ll keep it up until my younger son is out of high school and my son graduates college, but after that I’m out of at least my area and possibly the state. I have a plan and hopefully I can achieve that plan, but inflation and costs may impact that.

$12,000/year for property taxes? I’m only guessing, but I’d say your math is off.

Saltwater60

20×102mm Vulcan

As of now my taxes are slightly over $6,000. My tax rate for city, county, and school taxes are slightly over $41/$1,000 in home value. I’m projecting they will say my house will be assessed at $300,000 and that will equate to roughly $12,500/year in taxes for the three combined. I essentially get nothing other than my trash picked up for that fee. Yes I get some park use and what not.$1,000 a month in taxes? Hell id move too. I pay 4k a year with my acreage, house, and large garage.

Saltwater60

20×102mm Vulcan

I wish brother. Here is the breakdown. Now this is for city, school and county taxes, but that’s what I account for as property taxes. My town has the highest tax rate in all the county. My town is twice the rate of other towns around me in some instances.$12,000/year for property taxes? I’m only guessing, but I’d say your math is off.

looks like the rate for 22’ has dropped and I’ll be slightly under $11,000 now if I’m assessed at $300,000. I could be assessed higher or lower, but it’s getting done as we speak. This doesn’t take into effect my tax levy and I know the levy for county and school has increased since last year. The county rate did drop a bit. I don’t expect this to go well.

A small ranch around the corner sold for $209,000 a year ago. I have a large Victorian with more property and a garage three times the size of that one. I’m scared.

Attachments

Last edited:

Jsmegs77

.308 Win

There are many neighborhoods in my area that you’ll pay $800-$1,000/month in taxes alone. A tax assessment of $7000 on an assessment of $130K (a house my wife looked at in adjacent town), or my personal example of sticker shock moving up here from LI, a $4200/year tax bill on a house assessed at $72K in a shit neighborhood in Endicott.$12,000/year for property taxes? I’m only guessing, but I’d say your math is off.

Definitely not rare…

Saltwater60

20×102mm Vulcan

My brother was going to buy a house that was $450,000 in my town and the taxes were projected to be $17,000-$18,000/year. It was a divorce fight so he backed off because it was a mess. He’s glad he did.There are many neighborhoods in my area that you’ll pay $800-$1,000/month in taxes alone. A tax assessment of $7000 on an assessment of $130K (a house my wife looked at in adjacent town), or my personal example of sticker shock moving up here from LI, a $4200/year tax bill on a house assessed at $72K in a shit neighborhood in Endicott.

Definitely not rare…

Jsmegs77

.308 Win

That’s simply insane. Meanwhile, a former oilfield coworker of mine said the hell with all this, moved to somewhere in the vicinity of Searcy, Arkansas, and enjoys taunting a few of us with his 300k house and sub-$1000/year tax bill. And he gets his garbage picked up too.My brother was going to buy a house that was $450,000 in my town and the taxes were projected to be $17,000-$18,000/year. It was a divorce fight so he backed off because it was a mess. He’s glad he did.

Dr. Evil

20×102mm Vulcan

Over 8,000 a year in taxes on an 1800 square foot house on less than 1/3 of an acre. Add that to winters, liberal nut jobs, Stalinist politicians, one of my boys being out of NY with the other one planning the same and having less gun rights since the SCOTUS gave me back my gun rights and that my friends is the recipe for GTFO of here.

Acer-m14

20×102mm Vulcan

Midway...

View attachment 172861

midway was like back in the safe act and wouldn't even ship a BP rifle to a FFL back then .. FK midwayUSSR

PS .. post the damn links too and not just screen shot of it

PSS ..

NY State Senate Bill S51001

searched it for the word Black .. Zero hits .. Searched it for Muzzle Zero hits ..

Fuck MidwayUSSR and BUDS ..

PSSSS .. would like that link of Zip Codes

spat

.950 JDJ

Gun rights are the canary in the Cole mine.I’m not leaving the Adirondacks. This is my home. Intesrestingly, a lot of people say, “Just move to a free state,” when talking about guns and NYS. It’s as if owning guns is the pinnacle of life, yet, when the right to bear arms was amended in the Constitution, it was preserved such that the citizens of this nation could defend those things in life which were deemed essential: life, liberty, and the pursuit of happiness. Sure, that’s obviously from a different, yet monumentally important document regarding freedoms in this country, but it gets right to the point. The right to own guns is important; the things that are to be be protected and preserved by an armed citizenry are fundamental to the founding of our nation. It’s a chicken or egg, cart before the horse, eggs-in-one-basket case, all at once. Liberty protects our guns; our guns protect our liberty. Do we have liberty because we have guns, or do we have guns because we have liberty? Perhaps it is both, but I’m not leaving.

They aren't the important part. But if they go down, the important stuff is soon to follow.

So, sure, you can live without your guns, but what else can you live without ?

You'll be growing all your own food because the shelves are empty at the stores and next thing you know the boys in purple ties will show up to confiscate all of it because you are "hoarding" illegally.

Saltwater60

20×102mm Vulcan

Some one that was in the mix of all this BS just told me of this stands, meaning the CCIA, Hochul will pass a law declaring NYS gun free. I’m assuming it will exempt hunting but that’s it. Do I know this to be fact? Nah, but she sure pushed the envelope with this one so it makes sense.

thughes

.223 Rem

Some one that was in the mix of all this BS just told me of this stands, meaning the CCIA, Hochul will pass a law declaring NYS gun free.

As to your calculations and assumptions, your not off. My wife and I pay nearly 9k/year in school and property taxes, up significantly since we purchased 5 years ago ( nearly 2k more IN 5 YEARS). I consistently remind my wife that in less than 15 years we could pay for a SECOND HOME in taxes alone, let alone state income taxes and fees on top if that.For me I bought a house for $155,000 and my taxes are so high my wife was showing me $300,000-$330,000 Houses down south and I kept saying no way can we afford that why do you keep teasing me. Well turns out the payment is actually cheaper because the taxes are way cheaper. I’m looking at a reassessment right now and I project my tax bill after it will be $1,000/month and my mortgage right now is $1,350. My payment will near $2,000 if my projections are correct. I can’t do that, well I can but I just refuse to. I’ll keep it up until my younger son is out of high school and my son graduates college, but after that I’m out of at least my area and possibly the state. I have a plan and hopefully I can achieve that plan, but inflation and costs may impact that.

It reminds me of a conversation I had with my son in Colorado last year. He and his wife were going to buy thier first home. I reminded him to pay close attention to what his monthly tax payments would be for escrow and its significance on thier budget. Fast forward 1 month. The basics of the conversation were as follows;

(RING)- son-" Hey dad, we did it!"

Me- "Congratulations! Did you listen to me regarding taxes? "

Son- " Yeah"

Me- "Great! How much do you have to pay? "

Son-" 800"

Me- " On par if not less than what I pay monthly "

Son " No dad"

Me " what do you mean? "

Son " That's what I pay.....a year "

I will never forget that.

Last edited:

Beerman

6.5 Creedmoor

Probabably wouldn’t even take that long, depending on how many wives you have. I can afford one, but I don’t deserve her. ‘Nuther story fer a different thread…I consistently remind my wives that in less than 15 years we could pay for a SECOND HOME in taxes alone, let alone state income taxes and fees on top if that.

Caught the spellcheck error lol. Good eye. Live in NY and non Mormon lol, although Utah must be better....not on the wives thing. I will love mine until the end of my days, but 1 is enough.Probabably wouldn’t even take that long, depending on how many wives you have. I can afford one, but I don’t deserve her. ‘Nuther story fer a different thread…