John Stark

.44 mag

Genevieve Roch-Decter, CFA

@GRDecter

·

3h

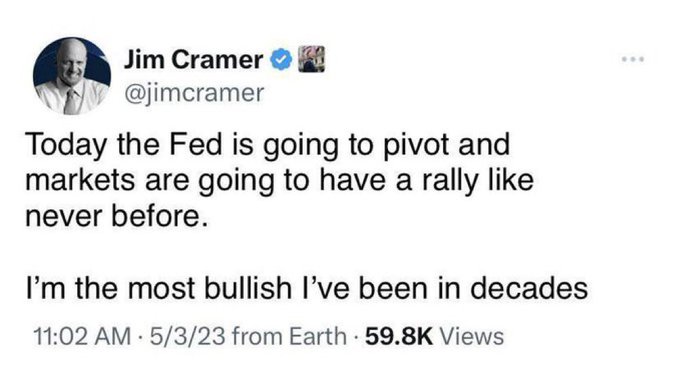

BREAKING: The FED raises rates 0.25%. ALSO BREAKING: Inverse Cramer never fails.

Show this thread

So sell then? Message received Jim, thanks buddy!

Genevieve Roch-Decter, CFA

@GRDecter

·

3h

BREAKING: The FED raises rates 0.25%. ALSO BREAKING: Inverse Cramer never fails.

Show this thread

CBDC to save the day and most will welcome it.

https://twitter.com/GRDecter

@GRDecter

BREAKING: PacWest Bancorp Stock Falls 55% in After-Hours Trading. Uh-oh.

Last edited5:37 PM · May 3, 2023

·

23.6K

Views

Back in line subject!!!If we can just print money then why do I pay taxes??

rightwirereport.com

rightwirereport.com

dailyhodl.com

dailyhodl.com

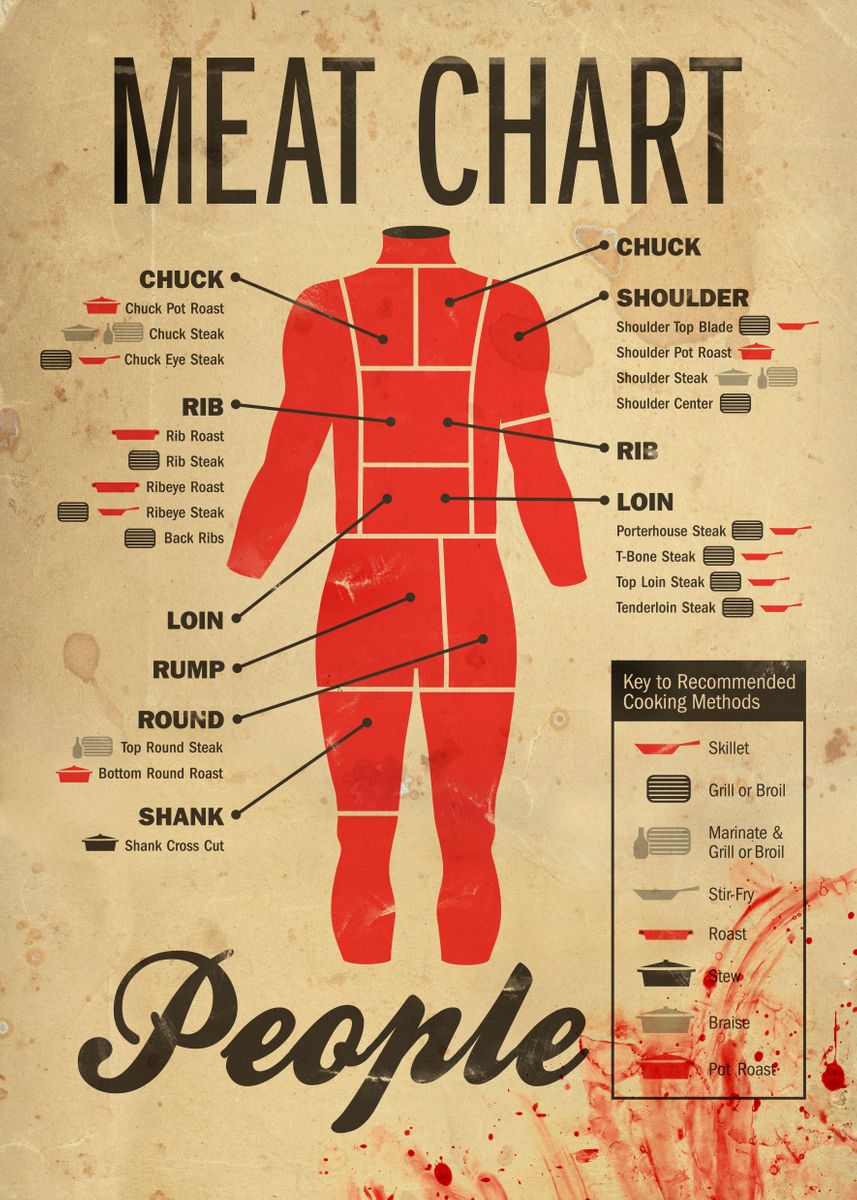

Geez, Hannibal Lector, are you stockpiling fava beans and a nice chianti to go with that?just saying lol

healthimpactnews.com

healthimpactnews.com

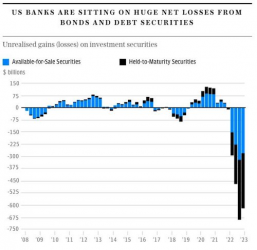

This is how the savings and loan crisis in the late 1970s - early 1980s started. People pulled their money out of them in favor of money market funds. Looks like history is repeating.

Lol. Petro Dollar is no more. Major impact!!I highly doubt there will be a debt crisis. If there is any consensus among all the media sources I consume on financial info -- which is basically all I do, all day long, is just background listen to the talking heads -- is that there is zero concern here that the debt limit will be raised.

Also, they seem in no way concerned about bank consolidation. This is actually quite normal. We used to have 14-15,000 banks years ago compared to the 4,000 or so we have now:

This has dwindled, and banks have "failed" due to competition when we started to allow our banks to operate across state lines, which is why we see these numbers dropping steadily over time. Previously we didn't allow, or states didn't allow, for financial institutions to operate across state lines.

We also have FAR more banks than other countries because we actually want to prevent consolidation of wealth institution wise due to it being riskier, if I recall the reasoning correctly. The UK, by contrast, only has a few hundred, if that.

So overall, the consensus I'm hearing is non-concern and business will carry on, after a pony show, as usual.

Backing the deposits with real assets is a band aid at best in a fractional reserve system.I agree with eliminating the Federal Reserve and getting rid of a very large swath of Federal (and state) spending.

Not that it really matters any longer, but I do think FedGov has a role to play in banking given our Constitution.

One step that I think would go a long ways would be to go back to something like Glass Steagall:

:max_bytes(150000):strip_icc()/bonds-lrg-2-5bfc2b24c9e77c00519a93b5.jpg)

Glass-Steagall Act of 1933: Definition, Effects, and Repeal

The Glass-Steagall Act was established in 1933 and repealed in 1999. It was designed to separate commercial banking and investment banking.www.investopedia.com

Depositor (commercial) banks should not be allowed to speculate at all in any paper markets, whether its stocks or bonds or whatever. Alternatively, depositor banks would be allowed to only invest in things that actually exist, like real estate, and other forms of property such as real manufactured goods. In other words, commercial bank investment would have to be backed up by real assets, not the paper trading scams. If the bank gets in trouble, there are real assets backing the deposits, and customers would have a right to not allow their funds to be invested in such a manner, paying a premium to opt out and have their money secured and untouchable. A pipe dream, I know!

Investment banking should not be allowed to do retail banking at all. Their depositors know that they are putting their money into investments that are NOT secure, and accept that risk. No FDIC, no Federal Reserve backstop. There would have to be heavy penalties for fraud, very heavy penalties. You invest, you know your money is AT RISK.

I also think that we should go back to 5 business days for all banking; banks of either type by law would be closed saturday and sunday. The onset of digital trading is bringing about a 24/7 need for anyone in the market to ride their portfolio and wonder when the next bankster/government crime wave is going to wipe them out because they wanted to spend a day with their family. To make up for the banks being closed on the weekends, I would make the banks open at 6am and remain open until 6pm, so most people can get there sometime during the day. I believe a 24/7 wide open market, where billions and trillions are being shuffled around, and currency speculation (money changing) is wide open, can not only lead to extreme volatility and rapid bankruptcy, but to rampant fraud and criminal schemes big and small. Further, I think a 24/7 cycle of bankster bullshit gives in to human oversight of their own wealth, and puts everyone at the mercy of banking programs and AI that no one can keep up with.

I know its a moral point I am making that a 24/7 banking/trading window is not healthy for people or society, but I stand by that. People need to get out of the bubble once in awhile and breathe some fresh air.

Also, I reject Fiat Money, digital currency, and money that is not backed up by tangible assets like precious metals and other commodities.

If that happens, then it doesn't matter what they do in DC, we're fucked.Lol. Petro Dollar is no more. Major impact!!

Since I am in favor of smashing the Federal Reserve into the dust bin of history and the fractional reserve system it created, your criticism has nothing to do with my position.Backing the deposits with real assets is a band aid at best in a fractional reserve system.

We are in agreement there.Since I am in favor of smashing the Federal Reserve into the dust bin of history and the fractional reserve system it created, your criticism has nothing to do with my position.

Not socialism. Totalitarianism. Much worse. lolthe fast way to Socialism ..

Same = Same.Not socialism. Totalitarianism. Much worse. lol