DoOver

.450/400 Nitro Ex

Muh weeding inwedimundt has your statement "American Taxpayers will now have to back stop SVB giving BLM $73 million blazie, blazie um blazie..."WOW... Silicon Valley Bank gave $73,450,000 to "BLM Movement & Related Causes"

Muh weeding inwedimundt has your statement "American Taxpayers will now have to back stop SVB giving BLM $73 million blazie, blazie um blazie..."WOW... Silicon Valley Bank gave $73,450,000 to "BLM Movement & Related Causes"

That sure helped them out didnt it?WOW... Silicon Valley Bank gave $73,450,000 to "BLM Movement & Related Causes"

WOW... Silicon Valley Bank gave $73,450,000 to "BLM Movement & Related Causes"

WOW... Silicon Valley Bank gave $73,450,000 to "BLM Movement & Related Causes"

I think it’s saying they care more about diversity and people than profits, well good work you’re closed.

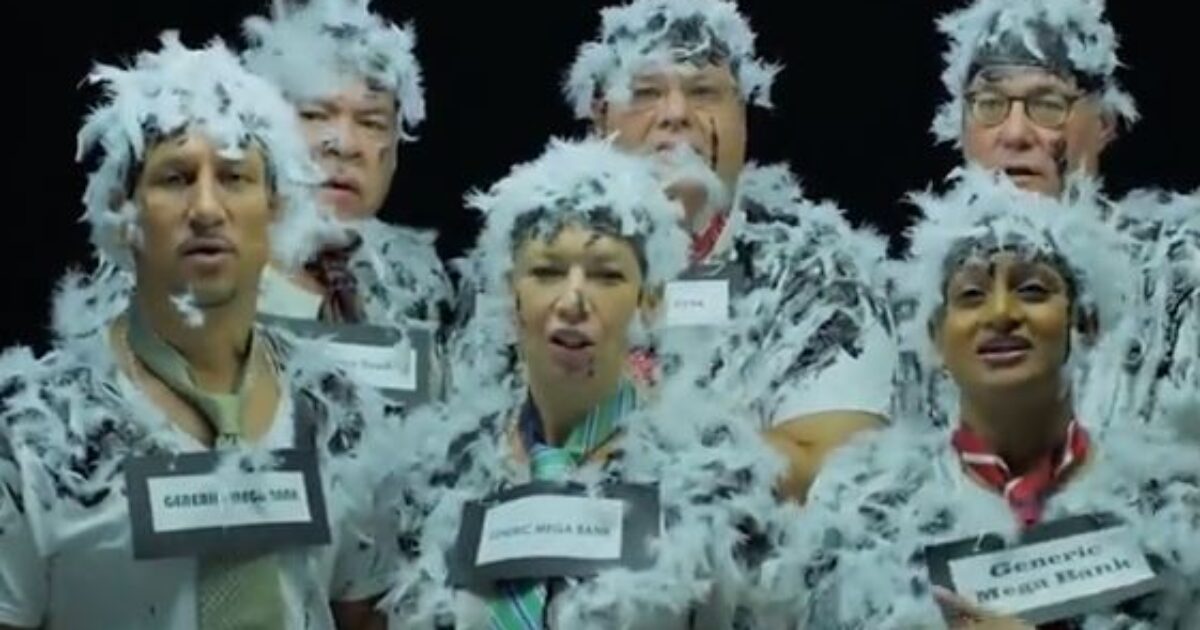

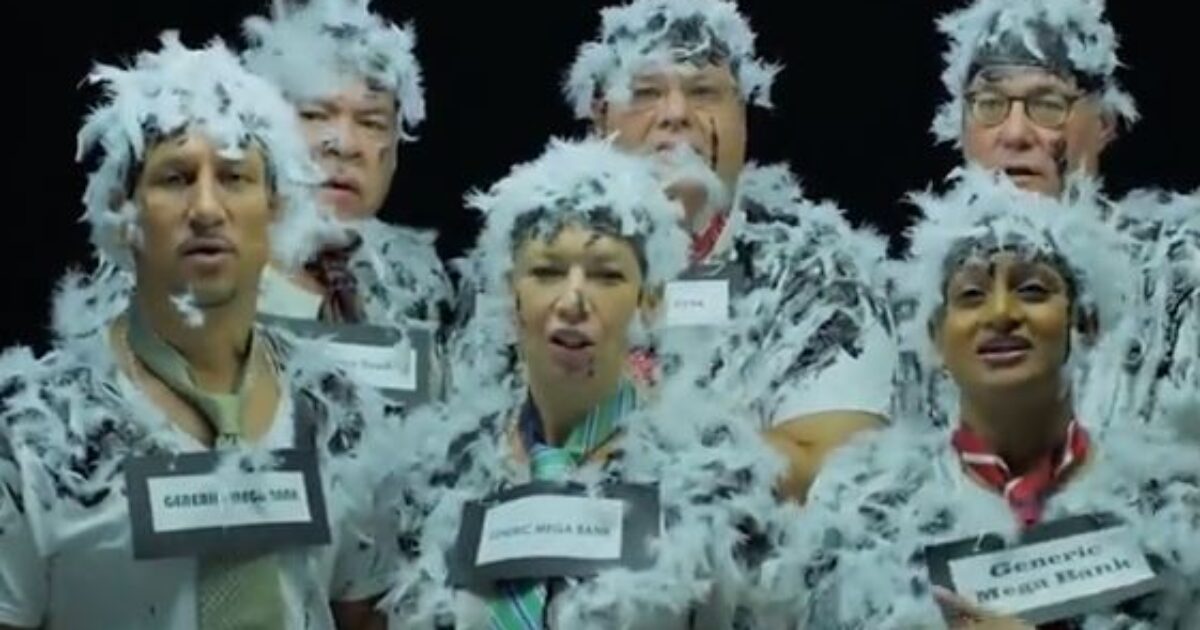

STUNNING Video Woke Signature Bank Made Before They Went Broke | The Gateway Pundit | by Jim Hoft

Before Signature Bank went broke they were releasing woke videos about how they were so open minded.www.thegatewaypundit.com

Must be my lack of financial understanding, but I always believed that an "investment" was giving money to a person or corporation with the expectation that I would receive more money than I gave back from them.The report details $82 billion dollars in social justice/BLM investments

WOW... Silicon Valley Bank gave $73,450,000 to "BLM Movement & Related Causes"

They should have used that money to hedge their interest rate risk on their long term Treasury portfolio. One thing I haven't read in all the articles is any talk of any effort to make offsetting investments to balance their risk. This is banking 101 and has been practiced for 40 years. I know because I used to work for a bank 25 years ago. Holding a large group of long term securities without hedging the risk is criminal mismanagement.That sure helped them out didnt it?

Thinking of opening a bank;

It will trade in primers, powder, brass, projectiles.

Plus I identify as Indian so no tax.

Its my view that this may not be criminal mismanagement in the sense that I believe you are implying (i.e., simple fiduciary negligence by corporate officers trying to hide losses incurred on bad investment choices the bank made), but that SVB was essentially a front, given the players involved in both its executive management and its board, and its list of investors, its ties to other corporations, its corporate sponsorship of organized criminals like BLM, its connections to the Clintons and the Obamanation, the questionable wheeling and dealing with tech startups (reminiscent in a way of the DotCom Bubble of yesteryear), and so on.They should have used that money to hedge their interest rate risk on their long term Treasury portfolio. One thing I haven't read in all the articles is any talk of any effort to make offsetting investments to balance their risk. This is banking 101 and has been practiced for 40 years. I know because I used to work for a bank 25 years ago. Holding a large group of long term securities without hedging the risk is criminal mismanagement.

Its my view that this may not be criminal mismanagement in the sense that I believe you are implying (i.e., simple fiduciary negligence by corporate officers trying to hide losses incurred on bad investment choices the bank made), but that SVB was essentially a front, given the players involved in both its executive management and its board, and its list of investors, its ties to other corporations, its corporate sponsorship of organized criminals like BLM, its connections to the Clintons and the Obamanation, the questionable wheeling and dealing with tech startups (reminiscent in a way of the DotCom Bubble of yesteryear), and so on.

It appears to me, the more I read, that we're looking at "a tangled web practiced to deceive."

In other words, just an extension of the Bankster movement that took over in 1913.

The Fed and the financial "industry" are nothing but legalized and organized criminal organizations.